How will National Insurance changes affect salary sacrifice?

National Insurance contributions will increase from April 2022 - and the side effect is an even stronger incentive for electric vehicle salary sacrifice. Here's why.

As life begins to get back to normal after the worst of the Covid-19 pandemic, the UK government is investing heavily in healthcare, aimed at improving services and bringing waiting lists back under control.

The Health and Social Care Levy will raise an additional £11.4bn in revenue - ringfenced for the NHS and social care - by introducing a 1.25%-point rise in National Insurance contributions for April 2022/23 tax year [1]. This amounts to a small rise in payments for both businesses and their employees and affects company car schemes, including salary sacrifice. However, the effects for low-CO2 vehicles are minimal.

How does salary sacrifice work?

Salary sacrifice schemes allow employees to exchange some of their gross salary for a range of attractive benefits - such as childcare, pensions and health insurance - at discounted rates that wouldn't be available to them as individuals. They're an effective way to recruit, motivate and retain staff, and can extend some of the perks of company car schemes to other employees.

The process is simple:

- Employees choose a car, their employer leases it on their behalf, then deducts the monthly cost from their salary.

- As long as that car emits 75g/km CO2 or less, then they’ll be taxed on it as a Benefit-in-Kind and pay income tax and National Insurance what’s left of their salary [2].

- Employers’ National Insurance contributions (NICs) are based on the car as a benefit, instead of the salary used to fund it.

This has made salary sacrifice a very affordable way to drive an electric or plug-in hybrid car. Benefit-in-Kind payments and NICs are based on what’s called a ‘taxable value’ – a percentage of the list price, which increases for vehicles with higher CO2 emissions (or shorter electric range for plug-in hybrids under 50g/km). New ultra-low tax bands introduced last year [3] mean the taxable value for vehicles under 50g/km is usually much lower than the salary given up – an added incentive for drivers to choose a plug-in.

What’s changing next year?

From April 2022, HMRC will apply a 1.25%-point levy on National Insurance contributions, which impacts how income and company car schemes are taxed [4]. This will continue to be collected the same way even after it becomes a tax in its own right 12 months later, and amounts to a permanent increase in NICs for employers and employee.

Those changes mean:

- Employees pay NICs at 12% for income over £184 per week and 2% for everything over £967 per week [5]. These will increase to 13.25% and 3.25% respectively. The levy does not affect their income tax or Benefit-in-Kind payments in 2022/23.

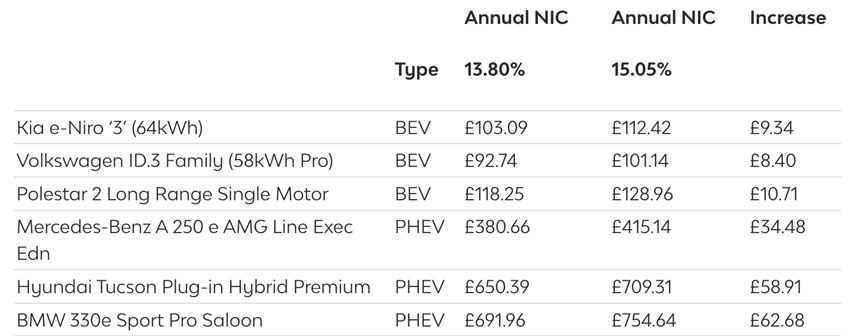

- Employer NICs are a flat rate of 13.8% for income over £170 per week, and for providing Benefits-in-Kind, such as a company car (including salary sacrifice schemes) [6]. In both cases, this increases to 15.05% for the 2022/23 financial year.

The levy will result in higher contributions for all employees and employers (excluding those earning less than the minimum income threshold). However, in monetary terms, the bulk of that increase comes from NICs on the salary itself. Drivers do not pay NICs on a company car, and the small taxable value of sub-50g/km vehicles means employers’ contributions will only go up by a small amount. Especially for battery-electric vehicles.

Some examples are shown below:

Worked examples:

Driver A earns £30,000 (gross) per year and is considering an electric vehicle with a £30,000 list price and lease rates of £250 per month on a salary sacrifice scheme.

- Benefit-in-Kind on the car (at 2%) adds £120 to their annual tax bill, but salary sacrifice reduces their income tax and NIC payments by £998. Their net annual tax bill is £5,316 (including a £218 levy), so salary sacrifice saves them £878.

- Salary sacrifice also reduces their employer’s NICs. There’s a £90 increase for providing the car as a benefit, but against a £452 reduction for the lower salary. The net contribution is £2,823 (including a £235 levy), saving them £361.

Driver B earns £60,000 (gross) per year and is considering a plug-in hybrid with a £50,000 list price, an electric range of 45 miles and CO2 emissions under 50g/km. Monthly lease rates are £400 per month on a salary sacrifice scheme.

- Benefit-in-Kind on the car (at 8%) adds £800 to their annual tax bill, but salary sacrifice reduces their income tax and NIC payments by £2,076. Their net annual tax bill is £15,867 (including a £570 levy), so salary sacrifice saves them £1,276.

- Their employer saves on NICs too, paying £602 to provide the car as a Benefit-in-Kind, but getting a £722 reduction due to the lower salary. Their net contribution is £7,579 (including a £630 levy), saving them £120.

Announced during the March 2021 Budget, income thresholds for tax and NIC have been frozen at 2021/22 levels until the 2025/26 financial year [7].

What’s Next?

We’re here to help. Since 2010, LeasePlan UK has set up dozens of salary sacrifice schemes covering more than 90,000 employees. Our expert consultancy team can talk you through the process, help you to meet your own goals and explain the benefits to your employees. We can also put you in touch with our existing customers, to find out first hand how other organisations have benefitted.

REFERENCES:

[1] HM Revenue and Customs. (2021). Health and Social Care Levy. [online] Available at: https://www.gov.uk/government/publications/health-and-social-care-levy/health-and-social-care-levy [Accessed 30 Sep. 2021].

[2] HM Revenue and Customs. (n.d.). Salary sacrifice for employers. [online] Available at: https://www.gov.uk/guidance/salary-sacrifice-and-the-effects-on-paye [Accessed 30 Sep. 2021].

[3] GOV.UK. (n.d.). Company car benefit ? the appropriate percentage (480: Appendix 2). [online] Available at: https://www.gov.uk/guidance/company-car-benefit-the-appropriate-percentage-480-appendix-2 [Accessed 30 Sep. 2021].

[4] Department of Health and Social Care. (2021). Build Back Better: Our Plan for Health and Social Care. [online] Available at: https://www.gov.uk/government/publications/build-back-better-our-plan-for-health-and-social-care/build-back-better-our-plan-for-health-and-social-care [Accessed 30 Sep. 2021].

[5] Government Digital Service (2021). National Insurance rates and categories. [online] GOV.UK. Available at: https://www.gov.uk/national-insurance-rates-letters [Accessed 30 Sep. 2021].

[6] HM Revenue and Customs. (2021). Rates and thresholds for employers 2021 to 2022. [online] Available at: https://www.gov.uk/guidance/rates-and-thresholds-for-employers-2021-to-2022 [Accessed 30 Sep. 2021].

[7] HM Revenue and Customs. (2021). Income Tax Personal Allowance and the basic rate limit from 6 April 2022 to 5 April 2026. [online] Available at: https://www.gov.uk/government/publications/income-tax-personal-allowance-and-the-basic-rate-limit-from-6-april-2022-to-5-april-2026/income-tax-personal-allowance-and-the-basic-rate-limit-from-6-april-2022-to-5-april-2026 [Accessed 30 Sep. 2021].

.jpg?rev=3adbd558867c4d92bf9f22752f12a09c&mw=600)