Accident management

We're there for you, even at the worst times

However careful you are when driving, accidents do happen. To keep this problem to a minimum, it is essential to know how to act in these situations.

What types of incident are there?

There are two types of incident: the isolated incident, which does not involve any third parties, and an incident involving third parties. The way in which notification is made is important so that the insurer can sort out the incident speedily and assertively.

How do I notify an incident?

Incidents are usually notified by means of the Mutual Statement of Automobile Accident. Although this is a document drawn up so that drivers involved in an incident with third parties can reach an amicable arrangement about liability, it is also used for isolated incidents.

Don’t forget to provide photos!

Besides completing the form, or even if there is an amicable agreement between the parties involved, it is always important to take photos of the accident site.

Photos showing the position of the cars on the road, the type of road, the signs in place, the damage caused and the identification of the vehicles by their registration plates may, in many cases, help to resolve and clarify any potential dispute about liability between the insurance companies.

And the authorities can help

In an accident, the intervention of the police authorities is always recommended when the participants are unable to reach an agreement. This being the case, the drivers will probably provide contradictory versions to their insurers. If so, aspects such as road measurements or an analysis of the accident site by the authorities may help to settle the dispute.

The witnesses, if there are any, must also be referred to and identified to the authorities. The presence of the authorities is also vital in case one of the vehicles involved does not have valid insurance or a driver does not have valid documents.

Assessment

When insurance is contracted with Ayvens, you have the following options available for damage assessment:

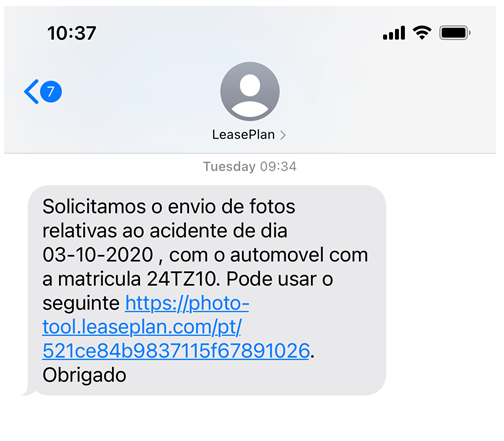

After the incident, if the car is circulating with only some minor damage and if the town/city for repair is Lisbon or Oporto, the loss adjustment and damage appraisal may be carried out using photos. After commencing the incident file procedure, the customer is contacted by Ayvens via SMS on the mobile phone with a link, where can send the photos that prove the car condition and make it possible to assess the damage. After the information is submitted, you must wait for contact from Ayvens or the workshop to schedule the repair.

See below how it works in just 3 steps:

1. Receive an SMS with a link

By clicking, you will be redirected to the Ayvens photo-tool, where you can submit all data in an easy and detailed way.

2. Take a photo from each angle

You can take it out at the moment, using the auxiliary “mask”, or attach existing photos. Just align the vehicle in the image.

At the workshop:

The driver books the day of the loss adjustment directly with Ayvens. On that day, the driver must leave his/her car at the selected workshop at its opening time. The loss adjuster, designated by Ayvens, shall proceed to the workshop to carry out the loss adjustment. As soon as the loss adjustment has been completed, the driver is notified to pick up his/her car.

This service is available at some workshops. The driver books directly with Ayvens the most suitable day to go to the workshop. Depending on the workshop, you may opt for the morning opening hours (from 8.30 a.m. to 11.30 a.m.) or the afternoon hours (from 2 p.m. to 5 p.m.). After choosing the period of the day, the customer may go to the workshop, wait no longer than 30 minutes and the loss adjustment will be carried out. This is because during this time period the loss adjuster is already at the workshop.

This service is also available at some workshops. The driver books directly with Ayvens the most suitable day to go to the workshop. Depending on the workshop, you may opt for the morning opening hours (from 8.30 a.m. to 12.00 p.m.) or the afternoon hours (from 2 p.m. to 5 p.m.). The workshop has a mechanism system integrated with the loss adjuster which allows damage appraisal using photos.

And last but not least, the repair!

There's always a solution.

The follow-up of the whole repair process at the workshop by Ayvens is what sets this service apart from a traditional insurer. From the day of the loss adjustment until the end of the repair, customers and drivers are given continuous feedback about the car repair status.

At a time when there are increasing difficulties getting parts by car manufacturers or workshops with less resources, delays in repairs are more frequent which may result in customer or driver dissatisfaction. So when the driver is informed about every step of his/her repair process, he/she will feel they have been properly cared for.

What’s more Ayvens has a specialised team for monitoring and witnessing, at the workshop, all the steps and looking for solutions to avoid any delays in repair.

Ayvens

It is always by your side. Even in the most difficult moments.

Market

As traditional insurers usually do.

Find your next lease car

We have selected some of the best special offers for you and for your business.