Budget 2023: What it means for fleets and drivers

The 2023 Budget contained fewer announcements for fleets and drivers than the Autumn Statement, but it did contain some significant ones. We explore them here.

Typically, the Budget is the main fiscal event of the year, full of new policy announcements, while the Autumn Statement is the secondary one, meant more as a basic update on the nation’s finances.

For fleets and drivers, that traditional dichotomy has recently been switched around. The Autumn Statement that the Chancellor, Jeremy Hunt, delivered last November contained some hugely significant announcements – from the rates of Company Car Tax (CCT) for 2025-26 and beyond to new Vehicle Excise Duty (VED) requirements for electric vehicles (EVs).

Whereas yesterday’s Budget was, expectedly, rather less significant. The Chancellor had less to say to fleets and drivers because he’d already said most of it back in November.

However, this doesn’t mean that the Budget can just be ignored. It contained at least one big – very big! – announcement for fleets and motorists, as well as numerous economic forecasts that pertain to practically everyone in the country. Here’s our breakdown of the most significant parts:

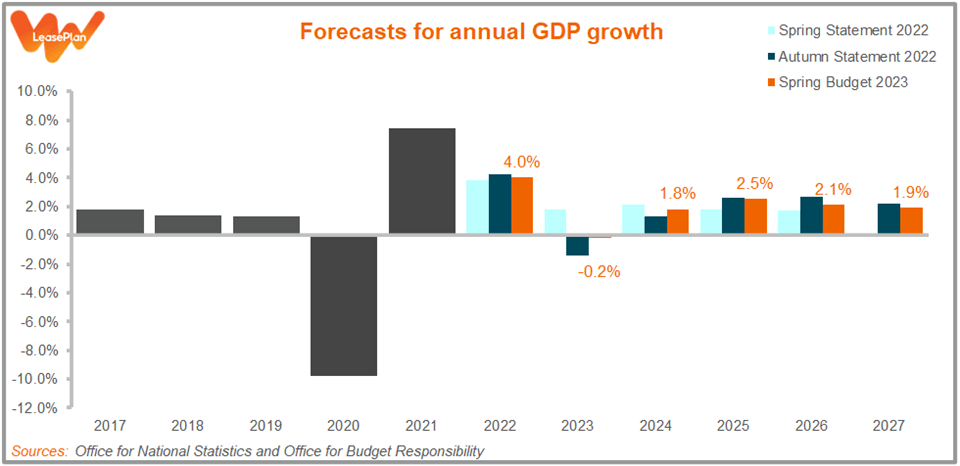

Economic growth: Better, but not good

Even just a few months ago, it looked as though the UK was set to enter a prolonged recession. Now, however? In his Budget speech, the Chancellor was able to proudly claim: “…we will not enter recession at all this year.”

This is, of course, good news for both businesses and individuals, but it also ought to be heavily caveated. For starters, the Chancellor was basing his pronouncement on forecasts provided by the Office for Budget Responsibility (OBR), and forecasts can be wrong – particularly at a time of extreme volatility in the world economy.

What’s more, the OBR still expects the economy to shrink this year – with “growth” of minus 0.2%. This only avoids counting as a recession on a technicality. A recession is defined as two consecutive quarters of negative economic growth. The minus 0.2% is an average for 2023 overall; a year in which, conveniently, it’s not currently expected that the economy will shrink for two quarters in a row.

In any case, while minus 0.2% is better than the minus 1.4% forecast by the OBR at the time of the Autumn Statement, it hardly speaks to a booming economy. And neither, really, do the forecasts for subsequent years. As a country, we still face many challenging months ahead.

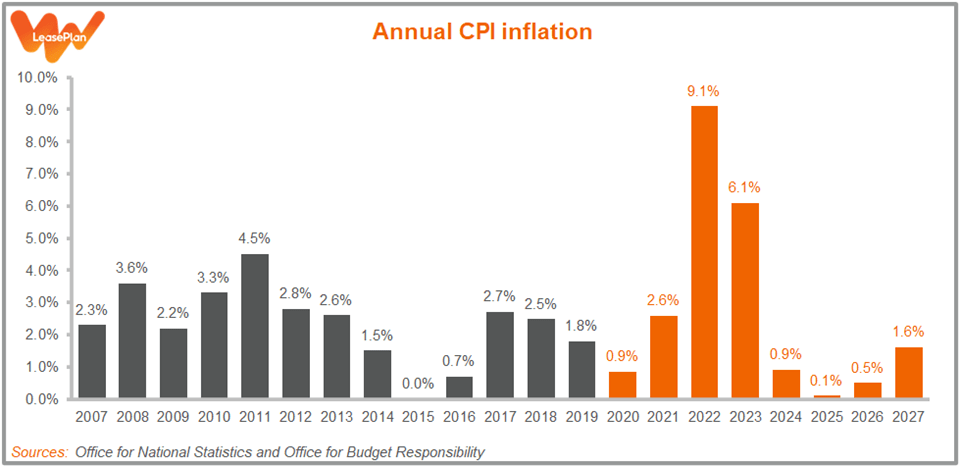

Inflation: Heading back down

Due in large part to the after-effects of the pandemic, as well as the shock of Russia’s invasion of Ukraine, we have all been living through a cost-of-living crisis. The main measure of inflation in the UK, the Consumer Prices Index (CPI), reached double figures last year – its highest level for around 40 years.

Thankfully, some of those effects are now abating – and inflation is coming down, too. In fact, the OBR now anticipates that CPI will decline from an average of 9.1% in 2022 to an average of 6.1% in 2023. The picture is even better if we look beyond those yearly averages to the OBR’s quarterly figures: they now expect inflation of just 2.9% in the fourth quarter of this year. That’s basically back to what might be called normal.

Of course, our previous caveat still applies: forecasts can be wrong. But these latest numbers are still cause for cheer, particularly as the Government also used the Budget to extend some of its anti-inflationary policies – including keeping the domestic Energy Price Guarantee (EPG) at £2,500 a year for an additional three months, until June, which is very welcome relief for EV drivers and their electricity bills.

Fuel Duty: The most significant freeze yet

For over a decade now, we’ve been used to the main rate of Fuel Duty being frozen each year, for another year, at 57.95p a litre.

There was a pleasant surprise in March last year, when then-Chancellor Rishi Sunak announced a one-year 5p cut in that main rate, bringing it down to 52.95p. But then there was an unpleasant surprise when his successor as Chancellor neglected to confirm in his Autumn Statement whether Fuel Duty would be frozen for yet another year from March 2023.

This threw up the prospect that, as of now, Fuel Duty could increase not just by inflation, but also by an additional 5p, as Sunak’s cut was reversed. Indeed, in November, the OBR warned what this could mean for pump prices: “It is expected to raise the price of petrol and diesel by around 12 pence a litre.”

The only hope was that Hunt would choose to use this Budget to take action before these increases took effect. And…

…he did. Not only did the Budget suspend the inflationary increase in Fuel Duty, it also kept Sunak’s 5p cut in place, meaning that the main rate will now be frozen at 52.95p a litre until at least next year. This is more generous that we might have expected, and is, of course, very welcome news. Although the future of motoring – and motoring taxation – is electric, this is no time to be hammering fleets and drivers who rely on fossil-fuelled vehicles.

Vehicle taxation: We’re still waiting…

There’s a bigger conundrum lying behind Fuel Duty: as more and more people move into EVs – and, remember, the Government wants practically all new car sales to be electric by 2030 – the tax revenues from petrol and diesel vehicles are going to drop enormously. The Treasury stands to lose £billions.

So another major form of vehicle taxation needs to be introduced – one that also encompasses EVs. It has been speculated, for years, that this would be Road Pricing, which effectively means charging vehicles for using roads. At the time of the Autumn Statement, there was even expectation that a full consultation and review process into the feasibility of Road Pricing was going to be announced.

As it turned out, that announcement didn’t happen at the time of the Autumn Statement. And it didn’t happen in the new Budget, either.

This is a rather mystifying state of affairs. If the biggest shake-up of motoring taxation in generations is going to happen ahead of 2030 – as it surely must – then it will need years of careful development and implementation. There is no real cause to delay that process now.

…and waiting

Road Pricing isn’t the only potential legislative change that we’re waiting on. In the run-up to this Budget, there was much demand for one change in particular: reducing the 20% VAT imposed on the electricity from public charge points so that it matches the 5% imposed on domestic charging. Sadly, however, the Chancellor didn’t choose to satisfy this demand – that VAT will remain at 20%.

What’s more, the past few years have been full of policies hinted at and announcements only half-made, including:

- A new system of VED for vans that was first mooted in 2018

- HMRC’s work on how we can, to quote Sunak in 2020, “use VED to further encourage the uptake of zero and ultra-low emission cars”

- The detail that’s required for the ZEV Mandate for manufacturers

- The actual introduction of the new public charging rules that have already been designed by various Government departments

The Budget didn’t clarify any of these policies. Perhaps no Budget ever will; enough time and enough Prime Ministers have passed that some of this legislation may now have been dropped.

But whatever the case, fleets and drivers deserve clarity. Only then can we properly plan for the future.